Investments Rules

- Home

- Investments Rules

Business investment in the UK: October to December 2023 revised results

Estimates of short-term indicators of investment in non-financial assets; business

investment and asset and sector breakdowns of total gross fixed capital formation.

1.Main points

- UK business investment increased by 1.4% in Quarter 4 (Oct to Dec) 2023, revised slightly from our initial estimate of a 1.5% increase in the provisional estimate; the main contributor to business investment growth was an increase in buildings investment.

- UK business investment is 2.8% above where it was the same quarter a year ago.

- Annual UK business investment increased by 5.5% in 2023, revised down from a 6.1% increase in the provisional estimate.

- UK whole economy investment (technically known as gross fixed capital formation (GFCF)), which includes business and public sector investment, increased by 0.9% in Quarter 4 2023, revised down from a 1.4% increase in the provisional estimate.

- UK GFCF is 0.5% above where it was the same quarter a year ago.

- Annual UK GFCF increased by 2.2% in 2023, revised down from a 2.9% increase in the provisional estimate.

2.Business investment and whole economy investment data

This publication contains the latest updates to UK business investment and UK whole economy investment (technically known as gross fixed capital formation (GFCF)), which includes business and public sector investment data. Data are open to revision from Quarter 1 (Jan to Mar) 2023 to Quarter 4 (Oct to Dec) 2023 in this publication.

Figure 1: Gross fixed capital formation (GFCF) and business investment both increased in Quarter 4 2023

UK business investment and whole economy investment, chained volume measure, seasonally adjusted, Quarter 1 (Jan to Mar) 1997 to Quarter 4 (Oct to Dec) 2023

Notes:

- Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to Sept) and Q4 refers to Quarter 4 (Oct to Dec).

- UK business investment, chained volume measure, seasonally adjusted, excluding the reclassification of British Nuclear Fuels (BNFL) in Quarter 2 2005.

- Quarter 2 2020 was the largest fall on record for gross fixed capital formation excluding the reclassification of British Nuclear Fuels (BNFL) in Quarter 2 2005.

- Index is referenced to Quarter 1 (Jan to Mar) 1997 = 100.

Business investment

UK business investment increased by 1.4% in Quarter 4 2023, and annual UK business investment increased by 5.5% in 2023.

Most of the Quarter 4 2023 growth was driven by buildings investment, as well as a smaller positive contribution from transport growth.

UK business investment levels in Quarter 4 2023 remain below those seen in the first half of the year the Bank of England Monetary Policy Report reported investment plans being held back by economic uncertainty, and by the cost and availability of finance.

Annual business investment growth in 2023 was driven by positive contributions from transport and buildings. Also, business investment was stronger in Quarter 1 2023 owing to the end of the temporary tax relief on qualifying capital asset investment, known as super-deduction on 31 March 2023. This provided an incentive to bring forward investment that would have been planned for a later date.

Whole economy investment

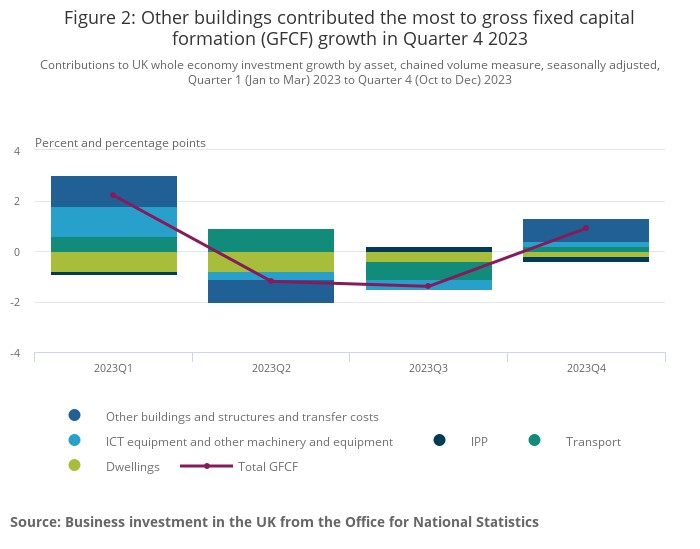

- UK GFCF increased by 0.9% in Quarter 4 2023, and annual UK GFCF increased by 2.2% in 2023. The primary driver behind this growth was other buildings contributing 0.9 percentage points, with small positive and negative contributions from the other components highlighted by Figure 2.

- Figure 2: Other buildings contributed the most to gross fixed capital formation (GFCF) growth in Quarter 4 2023

- Contributions to UK whole economy investment growth by asset, chained volume measure, seasonally adjusted, Quarter 1 (Jan to Mar) 2023 to Quarter 4 (Oct to Dec) 2023

Source: Business investment in the UK from the Office for National Statistics

- Notes:

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to

Sept) and Q4 refers to Quarter 4 (Oct to Dec).

Private investment in buildings contributed to most of the growth in buildings investment in the latest quarter, as

business investment drivers were the main source of GFCF growth.

Transport was the largest contributor to annual UK GFCF in 2023, with additional positive contributions from

information and communication technology (ICT) and other machinery and equipment, intellectual property

products (IPP), and buildings. This was partially offset by negative contributions from dwellings. There was also

additional strength from business investment in Quarter 1 2023 owing to the end of the super-deduction tax relief.

Page 5 of 10

Transport in 2023 saw growth in air transport, this was elevated in Quarter 2 (Apr to June) 2023 owing to

increased investment in aircraft, but there has also been longer term strength in the industry from the second half

of 2022. Transport investment can be particularly volatile because of the high value of some transport equipment.

Additionally, there was an increase in vehicle purchases throughout 2023. Comments showed rental car firms

fulfilled a backlog of orders from the coronavirus (COVID-19) pandemic as vehicles became more readily

available, and SMMT data showed a 17.9% increase in car registrations from December 2022 to December 2023.

The increase in car registrations was driven entirely by fleet investments, which increased 38.7% year on year.

3 . Revisions to business investment and whole economy investment data

Business investment

UK business investment for Quarter 4 (Oct to Dec) 2023 has been revised down to a 1.4% increase in this

revised release from 1.5% in the provisional estimate. This revision was caused by downward contributions from

transport, and information and communication technology (ICT) equipment and other machinery and equipment,

and offset by an upwards contribution from intellectual property products (IPP). These revisions are mostly the

result of later survey data.

Whole economy investment

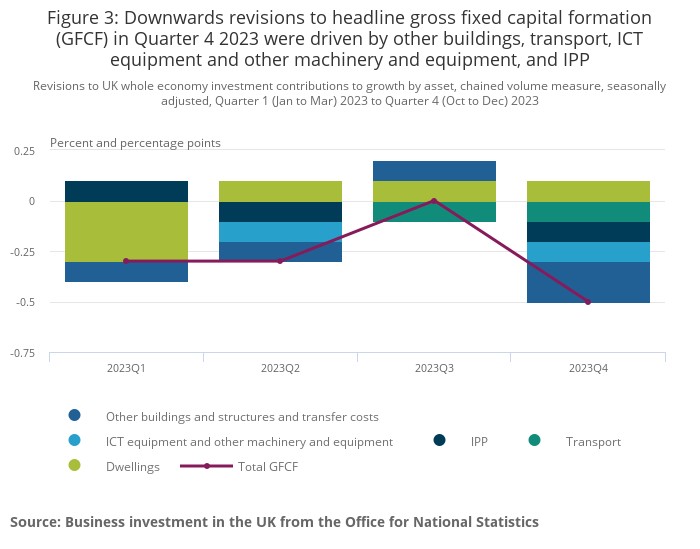

Figure 3: Downwards revisions to headline gross fixed capital formation (GFCF) in Quarter 4 2023 were

driven by other buildings, transport, ICT equipment and other machinery and equipment, and IPP

Revisions to UK whole economy investment contributions to growth by asset, chained volume measure, seasonally adjusted,

Quarter 1 (Jan to Mar) 2023 to Quarter 4 (Oct to Dec) 2023

Source: Business investment in the UK from the Office for National Statistics

Notes:

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to

Sept) and Q4 refers to Quarter 4 (Oct to Dec).

UK whole economy investment (technically known as gross fixed capital formation (GFCF)), which includes

business and public sector investment, was revised down to a 0.9% increase in the Quarter 4 2023 revised

release from 1.4% in the provisional estimate. This downwards revision is the result of small cumulative

downwards revisions in transport, ICT equipment and other machinery and equipment, IPP, and buildings.

Additionally, there was a small upwards revision in dwellings.

There were also downwards revisions of 0.3 percentage points to Quarter 1 (Jan to Mar) and Quarter 2 (Apr to

Jun) 2023. In Quarter 1 2023, this was mostly the result of a downwards revision to dwellings and in Quarter 2

2023, this was caused by smaller downwards revisions to ICT equipment and other machinery and equipment,

IPP, and buildings.

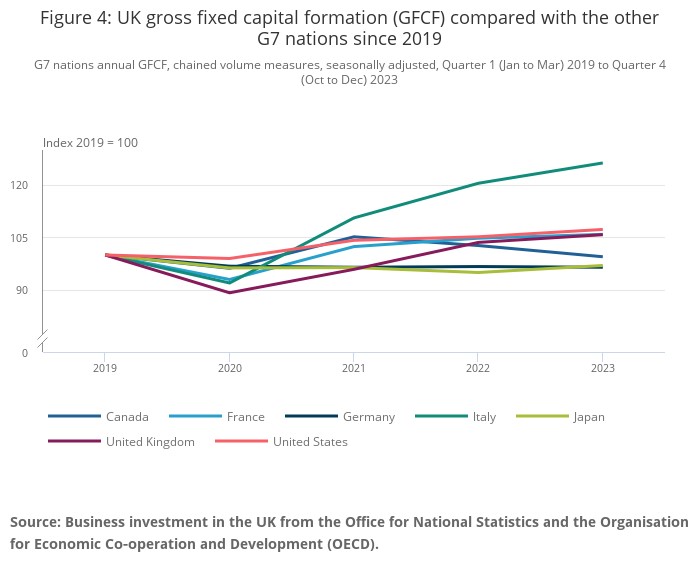

4 . International comparisons of whole economy investment for the G7 nations

Using data collated by the Organisation for Economic Co-operation and Development (OECD) from relevant

national statistical institutes, we can compare whole economy investment (labelled gross fixed capital formation

(GFCF) in OECD data tables) within the G7 nations. Figure 4 shows annual whole economy investment for the

G7 nations indexed to 2019=100, back to 2019.

UK GFCF increased by 2.2% in 2023, the second largest increase among the G7 nations, surpassed only by Italy

at 4.9%. UK GFCF had the largest fall of the G7 nations in 2020 at negative 10.8%, but has since had three

consecutive years of positive growth. Average GFCF growth in the UK since 2019, the pre-coronavirus (COVID19) pandemic year, has been similar to that of France and the United States.

Figure 4: UK gross fixed capital formation (GFCF) compared with the other G7 nations since 2019

G7 nations annual GFCF, chained volume measures, seasonally adjusted, Quarter 1 (Jan to Mar) 2019 to Quarter 4 (Oct to Dec)

2023

Source: Business investment in the UK from the Office for National Statistics and the Organisation for Economic Co-operation and Development (OECD).

Notes:

The Group of 7 (G7) nations is an intergovernmental organisation consisting of Canada, France, Germany,

Italy, Japan, the UK and the US.

The coronavirus (COVID-19) pandemic has affected each country in different ways and as a result,

restrictions have been put in place at differing times by each country.

Data was sourced from the OECD on 25 March 2024. This was the latest data available at the time of

production of this bulletin. It included provisional data and may subsequently have been revised.

Index is referenced to 2019 = 100

5 . Business investment data

Business investment by asset

Dataset | Released on 28 March 2024

Detailed breakdown of business investment by asset, in current prices and chained volume measures, nonseasonally adjusted and seasonally adjusted, UK.

Business investment by industry and asset

Dataset | Released on 28 March 2024

Detailed breakdown of business investment by industry and asset, in current prices and chained volume

measures, non-seasonally adjusted and seasonally adjusted, UK, Quarter 1 (Jan to Mar) 1997 to Quarter 2

(Apr to June) 2023.

Gross fixed capital formation – by sector and asset

Dataset | 28 March 2024

Sector and asset breakdowns of gross fixed capital formation (GFCF), including business investment and

revisions, in current prices and chained volume measures, non-seasonally adjusted and seasonally

adjusted, UK.

Quarterly Stocks Survey (QSS) and Capital Assets Survey (QCAS) Textual Data Analysis

Dataset | Released 28 March 2024

The indicators and analysis in this dataset are based on qualitative responses from comments left by

responding businesses to both our Quarterly Acquisitions and Disposals of (QCAS) and Quarterly Stocks

Survey (QSS).

Annual Gross fixed capital formation – by sector and asset

Dataset | Released 31 October 2023

Annual sector and asset breakdowns of gross fixed capital formation (GFCF), in current prices and chained

volume measures, non-seasonally adjusted and seasonally adjusted, UK.

6 . Measuring the data

Quality and methodology information on strengths, limitations, appropriate uses, and how the data were created

is available in the Business investment Quality and Methodology Information (QMI).

Revisions

In line with the National Accounts Revisions Policy, the earliest period open for revision in this publication is

Quarter 1 (Jan to Mar) 2023.

Data within this bulletin

All data within this bulletin, unless specified, are presented in chained volume measure (CVM). This means it has

the effect of price changes removed (in other words, the data are deflated).

In Quarter 4 (Oct to Dec) 2023, the Quarterly Acquisitions and Disposals of Capital Assets Survey (QCAS), the

largest data source for gross fixed capital formation (GFCF) and business investment, had a response rate of

77.2% for estimates used in the revised release.

Adjustments

Large capital expenditure tends to be reported later in the data collection period than smaller capital expenditure.

This means that larger expenditures are often included in the revised (month 3) results but are not reported in

time for the provisional (month 2) results. This can lead to a tendency toward upward revisions in the later

estimates for business investment and GFCF. Following investigation of the impact of this effect, from Quarter 3

(July to Sept) 2013, a bias adjustment was introduced in the provisional estimate.

This adjustment was suspended in Quarter 2 (Apr to June) 2020 because of uncertainties surrounding the effect

of the coronavirus (COVID-19) pandemic. However, since Quarter 4 2021, after further investigation and analysis

of its impact, the bias adjustment was reintroduced to business investment and GFCF. The bias adjustment, as is

usual, has been removed for the revised release.

8 . Related links

GDP Quarterly National Accounts UK: October to December 2023

Released 28 March 2024

Revised quarterly estimate of gross domestic product (GDP) for the UK. Uses additional data to provide a

more precise indication of economic growth than the first estimate.

National balance sheet estimates for the UK: 2023

Released 14 December 2023

Annual estimates of the market value of financial and non-financial assets for the UK, providing a measure

of the nation’s wealth.

Capital stocks and fixed capital consumption, UK: 2023

Released 8 December 2023

Annual estimates of the value and types of non-financial assets used in the production of goods or services

within the UK economy and their loss in value over time.

Experimental regional gross fixed capital formation (GFCF) estimates by asset type, UK: 1997 to 2022

Released 8 December 2023

Gross fixed capital formation estimates broken down by asset type, international territorial levels and local

authority districts.

A short guide to gross fixed capital formation and business investment

Released 25 May 2017

A useful background of how to interpret, compare and analyse statistics regarding gross fixed capital

formation and business investment.

9 . Cite this statistical bulletin

Office for National Statistics (ONS), released 28 March 2024, ONS website, statistical bulletin, Business

investment in the UK: October to December 2023 revised results

Business investment in the UK: January to March 2024 revised results

Estimates of short-term indicators of investment in non-financial assets; business

investment and asset and sector breakdowns of total gross fixed capital formation.

1 . Main points

UK business investment increased by 0.5% in Quarter 1 (Jan to Mar) 2024, revised down from our initial

estimate of a 0.9% increase in the provisional estimate.

The largest contributor to business investment growth was an increase in information and communication

technology (ICT) and other machinery and equipment investment.

UK business investment is 1.0% below where it was the same quarter a year ago.

UK whole economy investment (technically known as gross fixed capital formation (GFCF)), which includes

business and public sector investment, increased by 0.9% in Quarter 1 2024, revised down from a 1.4%

increase in the provisional estimate.

UK GFCF is 0.8% below where it was the same quarter a year ago.

2 . Business investment and whole economy investment data

This publication contains the latest updates to UK business investment and UK whole economy investment

(technically known as gross fixed capital formation (GFCF)), which includes business and public sector

investment data. Only Quarter 1 (Jan to Mar) 2024 data is open to revision.

Figure 1: Gross fixed capital formation (GFCF) and business investment both increased for

the second consecutive quarter

UK business investment and whole economy investment, chained volume measure, seasonally adjusted,

Quarter 1 (Jan to Mar) 1997 to Quarter 1 2024

Notes:

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to

Sept) and Q4 refers to Quarter 4 (Oct to Dec).

UK business investment, chained volume measure, seasonally adjusted, excluding the reclassification of

British Nuclear Fuels (BNFL) in Quarter 2 2005.

Quarter 2 2020 was the largest fall on record for gross fixed capital formation excluding the reclassification

of British Nuclear Fuels (BNFL) in Quarter 2 2005.

Index is referenced to Quarter 1 (Jan to Mar) 1997 = 100.

Business investment

UK business investment increased by 0.5% in Quarter 1 (Jan to Mar) 2024 and is 1.0% below where it was the

same quarter a year ago.

The Quarter 1 2024 growth is mostly driven by positive contributions from information and communication

technology (ICT) equipment and other machinery and equipment investment and buildings investment. This is

offset by negative contributions from intellectual property products (IPP), while contributions from transport were

broadly flat.

UK business investment fell in Quarter 1 2024 relative to the same quarter a year ago. There were negative

contributions from most headline components, with IPP contributing the most to the fall in business investment.

Transport was the only component to contribute positively to headline business investment over this period.

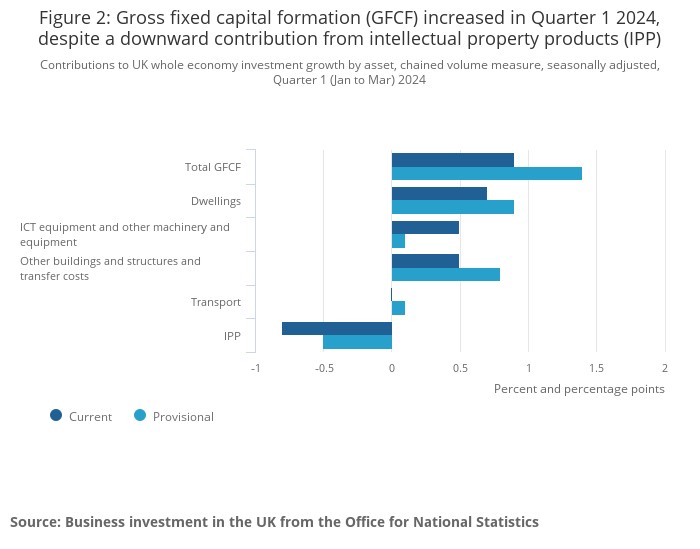

Whole economy investment

UK GFCF increased by 0.9% in Quarter 1 2024 and is 0.8% below where it was the same quarter a year ago.

The main contributors to the growth in GFCF in the latest quarter are dwellings, buildings, and ICT equipment

and other machinery and equipment. These positive contributions are offset by a fall in IPP relative to the

previous quarter, while transport growth is flat this quarter. These contributions are highlighted in the latest

quarter data in Figure 2.

Figure 2: Gross fixed capital formation (GFCF) increased in Quarter 1 2024, despite a downward

contribution from intellectual property products (IPP)

Contributions to UK whole economy investment growth by asset, chained volume measure, seasonally adjusted, Quarter 1

(Jan to Mar) 2024

Source: Business investment in the UK from the Office for National Statistics

Notes:

Q1 refers to Quarter 1 (Jan to Mar), Q2 refers to Quarter 2 (Apr to June), Q3 refers to Quarter 3 (July to

Sept) and Q4 refers to Quarter 4 (Oct to Dec)

3 . Revisions to business investment and whole economy investment data

Business investment

UK business investment for Quarter 1 (Jan to Mar) 2024 has been revised down to a 0.5% increase in this

release from 0.9% in the provisional estimate. This revision was caused by downward contributions from

intellectual property products (IPP), transport and buildings investment, and slightly offset by a positive revision to

information and communication technology (ICT) equipment and other machinery and equipment investment.

Whole economy investment

UK whole economy investment (technically known as gross fixed capital formation (GFCF)), which includes

business and public sector investment, was revised down to a 0.9% increase in this release from 1.4% in the

provisional estimate. These changes from the provisional estimate can be seen in Figure 2. This downwards

revision is the result of downwards revised contributions from most of the headline GFCF components: buildings,

IPP, dwellings and transport. ICT equipment and other machinery and equipment investment was the only

component with an upwards revision to its contribution.

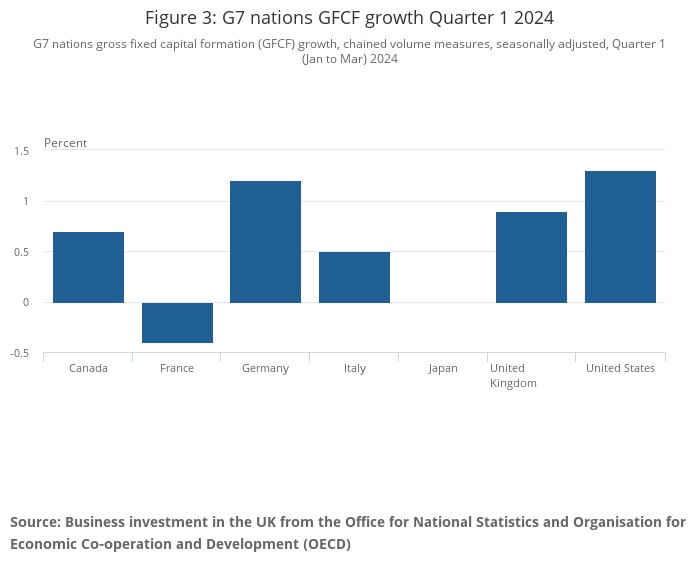

4 . International comparisons of whole economy investment for the G7 nations

Using data collated by the Organisation for Economic Co-operation and Development (OECD) from relevant

national statistical institutes, we can compare whole economy investment (labelled gross fixed capital formation

(GFCF) in OECD data tables) within the G7 nations. Figure 3 shows quarterly whole economy investment growth

for the G7 nations in Quarter 1 (Jan to Mar) 2024.

Figure 3: G7 nations GFCF growth Quarter 1 2024

G7 nations gross fixed capital formation (GFCF) growth, chained volume measures, seasonally adjusted, Quarter 1 (Jan to

Mar) 2024

Source: Business investment in the UK from the Office for National Statistics and Organisation for Economic Co-operation and

Development (OECD)

Notes:

The Group of 7 (G7) nations is an intergovernmental organisation consisting of Canada, France, Germany,

Italy, Japan, the UK and the US.

Data was sourced from OECD on 19 June 2024, and was the latest data available at the time of production

of this bulletin and included provisional data and may subsequently have been revised.

5 . Business investment data

Business investment by asset

Dataset | Released on 28 June 2024

Detailed breakdown of business investment by asset, in current prices and chained volume measures, nonseasonally adjusted and seasonally adjusted, UK.

Business investment by industry and asset

Dataset | Released on 28 June 2024

Detailed breakdown of business investment by industry and asset, in current prices and chained volume

measures, non-seasonally adjusted and seasonally adjusted, UK, Quarter 1 (Jan to Mar) 1997 to Quarter 1

2024.

Gross fixed capital formation – by sector and asset

Dataset | 28 June 2024

Sector and asset breakdowns of gross fixed capital formation (GFCF), including business investment and

revisions, in current prices and chained volume measures, non-seasonally adjusted and seasonally

adjusted, UK.

Quarterly Stocks Survey (QSS) and Capital Assets Survey (QCAS) Textual Data Analysis

Dataset | Released 28 June 2024

The indicators and analysis in this dataset are based on qualitative responses from comments left by

responding businesses to both our Quarterly Acquisitions and Disposals of (QCAS) and Quarterly Stocks

Survey (QSS).

Annual Gross fixed capital formation – by sector and asset

Dataset | Released 31 October 2023

Annual sector and asset breakdowns of gross fixed capital formation (GFCF), in current prices and chained

volume measures, non-seasonally adjusted and seasonally adjusted, UK.

7 . Measuring the data

Quality and methodology information on strengths, limitations, appropriate uses, and how the data were created

is available in our Business investment Quality and Methodology Information (QMI).

Revisions

In line with our National Accounts Revisions Policy, the only period open for revision in this publication is Quarter

1 (Jan to Mar) 2024.

Data within this bulletin

All data within this bulletin, unless specified, are presented in chained volume measure (CVM). This means it has

the effect of price changes removed (in other words, the data are deflated).

In Quarter 1 (Jan to Mar) 2024, the Quarterly Acquisitions and Disposals of Capital Assets Survey (QCAS), the

largest data source for gross fixed capital formation (GFCF) and business investment, had a response rate of

75.9% for estimates used in the revised release.

Adjustments

Large capital expenditure tends to be reported later in the data collection period than smaller capital expenditure.

This means that larger expenditures are often included in the revised (month three) results but are not reported in

time for the provisional (month two) results. This can lead to a tendency toward upward revisions in the later

estimates for business investment and GFCF. Following investigation of the impact of this effect, from Quarter 3

(July to Sept) 2013, a bias adjustment was introduced in the provisional estimate.

This adjustment was suspended in Quarter 2 (Apr to June) 2020 because of uncertainties surrounding the effect

of the coronavirus (COVID-19) pandemic. However, the bias adjustment was reintroduced to business investment

and GFCF after further investigation and analysis of its impact since Quarter 4 (Oct to Dec) 2021. The bias

adjustment, as usual, has been removed for the revised release.

8 . Related links

GDP quarterly national accounts UK: January to March 2024

Bulletin | Released 28 June 2024

Revised quarterly estimate of gross domestic product (GDP) for the UK. Uses additional data to provide a

more precise indication of economic growth than the first estimate.

The national balance sheet and capital stocks, preliminary estimates, UK: 2024

Bulletin | Released 13 June 2024

Preliminary annual estimates of the national balance sheet, by type of financial and non-financial asset for

the UK. Includes estimates of net capital stocks that are used in the production process and their loss of

value over time.

Capital stocks and fixed capital consumption, UK: 2023

Bulletin | Released 8 December 2023

Annual estimates of the value and types of non-financial assets used in the production of goods or services

within the UK economy and their loss in value over time.

Experimental regional gross fixed capital formation (GFCF) estimates by asset type, UK: 1997 to 2022

Article | Released 8 December 2023

Gross fixed capital formation estimates broken down by asset type, international territorial levels and local

authority districts.

A short guide to gross fixed capital formation and business investment

Article | Released 25 May 2017

This article provides a useful background of how to interpret, compare and analyse statistics regarding gross

fixed capital formation and business investment.

9 . Cite this statistical bulletin

Office for National Statistics (ONS), released 28 June 2024, ONS website, statistical bulletin, Business

investment in the UK: January to March 2024 revised results